Disclaimer:

This article is for informational and educational purposes only. I am not a certified financial advisor, and this content should not be considered financial advice. The strategies discussed here are based on personal research and experience. You should always conduct your own due diligence and consult with a qualified professional before making any investment decisions.

1. Introduction: The Rise of Passive Income Ideas

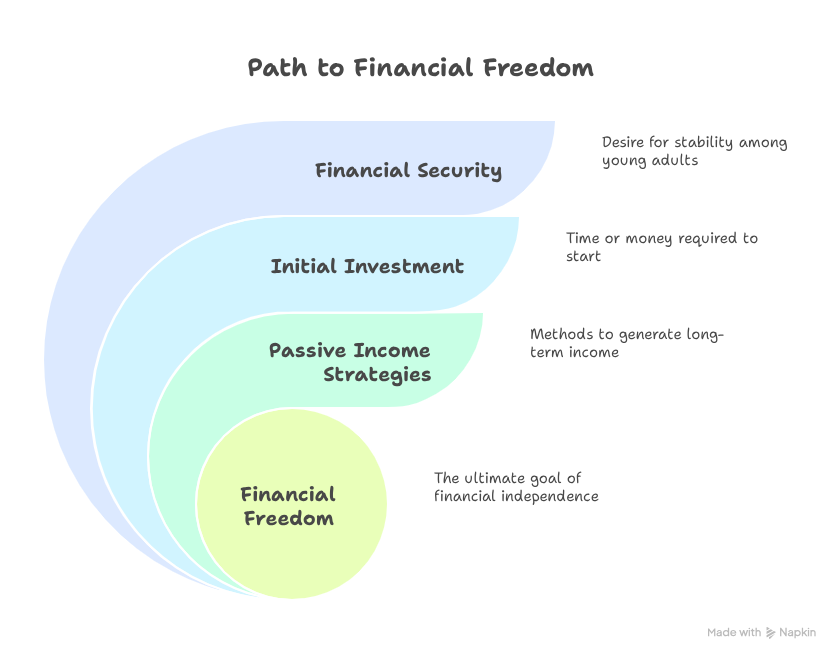

The financial landscape is shifting, and with it, so are the aspirations of a new generation. According to a 2024 survey by Deloitte, over 50% of Gen Z and millennials feel they’re living paycheck to paycheck, which has intensified their search for financial security. This desire for flexibility and a reliable backup plan has made passive income ideas more relevant than ever. This guide is your roadmap to understanding the most viable passive income ideas 2025 and beyond.

The term “passive” often creates a misconception of getting rich quickly with no effort. In reality, every passive income stream requires an initial investment of either time, money, or both. The true essence of passive income is about building an asset today that generates returns for you in the long run, freeing up your time for other pursuits. At WealthBooster360, my goal is to provide well-researched, experience-based content on topics concerning your financial well-being. While I am not a certified professional, the information here is carefully gathered and presented to help you on your journey toward financial freedom. Every strategy is vetted for its potential, risks, and feasibility, allowing you to build a foundation for long-term wealth.

2. Investment-Based Passive Income Ideas

These ideas generally require an upfront capital investment but can be less demanding on your time once they are established. The key is to make your money work for you, not the other way around.

Passive Income Idea #1: Rental Properties 🏡

Investing in real estate has long been a classic path to wealth. Rental properties provide steady cash flow from rent and offer a significant opportunity for asset appreciation over time. This strategy can be more or less passive depending on your approach.

- Long-Term Rentals: This is the most traditional method. You buy a residential property and rent it out to a tenant on a long-term lease, typically a year or more. The “passive” element comes from hiring a property manager to handle everything from tenant screening and rent collection to maintenance issues and repairs. While this eats into your profit margin (typically 8-12% of the monthly rent), it makes the income truly hands-off.

- Vacation Rentals: Platforms like Airbnb and Vrbo allow you to rent out a property on a short-term basis. This can yield higher returns, especially in tourist-heavy locations, but it is often more hands-on. You must manage a continuous stream of bookings, guest communication, and cleaning services between stays. Hiring a local co-host or a specialized management company can make this more passive, but at a higher cost.

- Pros: Potential for both cash flow and appreciation, a tangible asset you can control.

Cons: High upfront cost, risk of vacancies, and maintenance issues.

Trust Signal: It’s critical to note that regulations for short-term rentals vary widely by city and country. Always research your local laws and HOA rules before investing.

Passive Income Idea #2: Vending Machines 🍬

A semi-passive business model that is experiencing a resurgence. You purchase the machines and stock them, but once a good location is secured, they can generate consistent income with minimal day-to-day effort.

- Initial Investment: The upfront cost of a new or refurbished machine can range from $1,000 to over $10,000, not including inventory costs. This requires careful budgeting and market research to ensure profitability.

- The Search for Location: Finding a high-traffic location is the single most important factor for success. Common spots include office buildings, gyms, laundromats, and community centers. You’ll need to negotiate a commission with the property owner.

How it Becomes Passive: Once you’ve secured a good location and filled the machine, the work becomes limited to restocking and collecting cash. Many modern machines come with remote monitoring software, allowing you to track inventory levels and sales data from your phone, which significantly reduces the time commitment and makes this one of the more attractive passive income ideas 2025.

3. Digital Asset Passive Income Ideas

These strategies are often described as “build once, sell forever.” They require a significant upfront time investment to create the asset, but the potential for long-term, scalable passive income is high.

Passive Income Idea #3: Create an Online Course 🎓

If you have expertise in a specific area, you can create a video course and sell it on platforms like Udemy, Teachable, or Skillshare. The e-learning market is booming, with a Statista report projecting it to reach over $400 billion by 2026, highlighting a massive and growing demand.

- The Process: The work is concentrated in the beginning: planning a comprehensive curriculum, scripting lessons, recording high-quality videos, and creating supplemental materials like quizzes and handouts. This can be a substantial time commitment.

- Monetization & Scalability: Once your course is live on a platform, you can earn royalties on every sale, often for years to come. The beauty of this model is its scalability: you can sell your course to thousands of students without any additional time investment from your end. The platform handles the payment processing and delivery, making it a truly hands-off process after the initial launch.

Passive Income Idea #4: E-books 📚

Similar to online courses, an e-book leverages your knowledge to create a digital product. You can self-publish on platforms like Kindle Direct Publishing and earn royalties on every sale, with no need to manage inventory or shipping.

- The Appeal: The barrier to entry is low. You don’t need a publishing deal or a big budget. Your main investment is time, writing, editing, and designing a captivating cover.

- Long-Term Potential: A well-written e-book on an evergreen topic (e.g., personal finance, cooking, or productivity) can continue to generate passive income years after its initial publication. You can also drive traffic to your e-book from other content platforms like a blog or YouTube channel.

Passive Income Idea #5: Blogging ✍️

While blogging is not entirely passive initially, it can become a strong passive income engine over time. It requires a significant time investment to create content and build an audience, but the rewards are substantial.

- Monetization: Once you have a steady stream of traffic, you can make money through various methods:

- Display Ads: By placing ads on your blog through ad networks like Mediavine or AdThrive, you can earn revenue based on clicks or views.

- Affiliate Marketing: As the content builds, you can seamlessly integrate affiliate links to products you recommend, earning a commission on every click and sale.

Selling Your Own Products: A blog is a fantastic platform for selling your own digital products, like the e-books or courses mentioned above.

Passive Income Idea #6: YouTube Channel ▶️

The YouTube platform offers a powerful way to create a passive income stream. While it takes consistent effort to grow a channel, an established library of videos can generate revenue from ads and affiliate links for years.

- Evergreen Content: The key to true passive income on YouTube is to focus on content that remains relevant over time. “How-to” guides, educational videos, and historical content can continue to bring in views and ad revenue long after you publish them.

- Diversification: A successful YouTube channel can be a hub for other passive income ideas, driving traffic to your blog, online courses, or dropshipping store, creating a robust ecosystem of revenue streams.

4. Strategic & Hands-Off Passive Income Ideas

These ideas require a strategic approach and can be scaled to become more or less passive depending on the level of automation you implement.

Passive Income Idea #7: Affiliate Marketing 🔗

Affiliate marketing is a low-cost, high-leverage strategy. You earn a commission by recommending products or services to your audience and linking to them. Once the content is created, it can generate income over time.

- How it Works: You sign up for a company’s affiliate program, get a unique tracking link, and promote their products. When someone uses your link to make a purchase, you get paid.

- The “Passive” Element: The passive part comes from evergreen content. A well-written product review or guide on your blog that ranks highly on Google can generate sales 24/7 without any further effort from you. Transparency Note: You must always include a clear and conspicuous disclaimer when using affiliate links to maintain trust with your audience.

Passive Income Idea #8: Dropshipping 📦

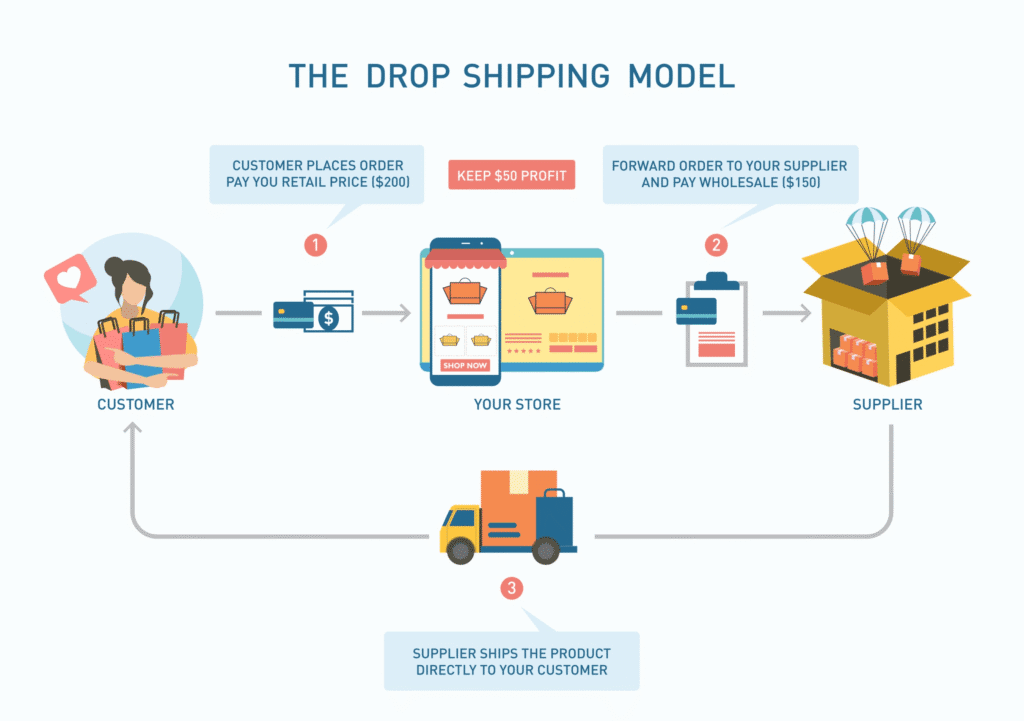

This e-commerce model allows you to sell products without holding any inventory. When a customer places an order, the product is shipped directly from a third-party supplier.

- The Appeal: This model is appealing because of its low startup costs and potential for automation. You can set up an online store on platforms like Shopify and integrate it with dropshipping apps that automate order fulfillment.

- The Reality: While often presented as passive, dropshipping requires significant ongoing effort to manage customer service, marketing, and supplier relationships. It is more accurately described as a semi-passive business model.

Passive Income Idea #9: Selling Stock Photos 📸

If you have a passion for photography, you can sell your photos on stock photography websites like Shutterstock or Adobe Stock.

- The Process: You upload high-quality photos to these platforms. Once your images are approved, they are made available for purchase by businesses, bloggers, and designers worldwide.

- True Passive Income: Once a photo is uploaded and accepted, it can be licensed repeatedly, generating a small but consistent passive income stream with no additional effort from you. This is one of the truest forms of passive income, although it can take a long time to build up a substantial portfolio.

Passive Income Idea #10: Dividend ETFs 📈

Dividend ETFs (Exchange-Traded Funds) are an excellent way to earn passive income from the stock market without the risk of investing in a single company. These funds hold a basket of stocks that consistently pay dividends, distributing the earnings to you on a regular basis.

- What is an ETF? An ETF is a type of investment fund that is traded on a stock exchange. It holds a collection of assets (like stocks from various companies) and is designed to track a specific market index.

- The Benefits: Dividend ETFs offer instant diversification, reducing your risk compared to buying individual stocks. They also provide a predictable cash flow from dividends, making them a great source of passive income.

- Regional Nuance: In the US, platforms like Vanguard and Fidelity are popular for low-cost ETFs. For investors in India, platforms like Zerodha make it easy to buy dividend-yielding ETFs, while Canadians can use platforms like Wealthsimple and Australians can use CommSec.

5. Conclusion: Your Action Plan for Passive Income

Building a passive income stream is not a myth; it’s a strategic process. The key is to choose an idea that aligns with your skills, resources, and risk tolerance. Start small, do your due diligence, and be patient. Remember, the most profitable passive income ideas often come from a combination of smart planning and consistent effort.

Passive Income Checklist for 2025

✅ Pick one passive income idea from this list that excites you.

✅ Research local platforms and legalities in your region (US, UK, India, etc.).

✅ Start small by testing your idea with a minimal investment.

✅ Scale gradually as you gain experience and confidence.

By focusing on well-researched, transparent information, I hope this guide has provided you with the confidence to begin your journey toward financial freedom. Your future self will thank you for taking the first step today.

Want weekly strategies to grow your wealth? Subscribe to WealthBooster360’s newsletter and join thousands of readers building financial freedom.

FAQs (Frequently Asked Questions)

Q: What are the best passive income ideas for beginners in 2025?

A: For beginners, low-capital ideas like affiliate marketing or selling digital products (e.g., templates or e-books) are great starting points. These allow you to learn the ropes without significant financial risk.

Q: Can I start passive income with no money?

A: While most passive income ideas require some form of investment (time or money), some can be started with very little capital. For instance, creating a YouTube channel or a blog can be done with a low-cost or free setup, but it will require a significant investment of your time.

Q: Which passive income streams are safest?

A: There is no such thing as a “risk-free” investment. However, some streams are generally considered safer than others, such as high-yield savings accounts or dividend-paying ETFs from stable companies. These typically offer lower returns but are less volatile than high-risk investments.

Q: How much passive income can I realistically earn in 2025?

A: The amount of passive income you can earn in 2025 depends entirely on the stream. For example, a digital product might start by earning a few dollars a month, while a substantial investment in real estate or dividend stocks could yield hundreds to thousands, depending on your initial capital, effort, and region.

Cited Sources (for credibility):

- Deloitte: “2025 Gen Zs and Millennials At Work”

- Official Link: https://www.deloitte.com/us/en/insights/topics/talent/2025-gen-z-millennial-survey.html

- Credibility: Deloitte is a global professional services network and a leading source of business and economic research. Citing their annual survey on generational trends is a strong signal of credibility.

- Statista: “E-learning market revenue forecast”

- Official Link: https://www.statista.com/outlook/edco/e-learning/worldwide

- Credibility: Statista is a highly respected global data and business intelligence platform. Their forecasts are widely used and cited by media, academic researchers, and businesses.

- Investopedia: “What are REITs?”

- Official Link: https://www.investopedia.com/articles/03/013103.asp

- Credibility: Investopedia is a trusted, go-to resource for financial education. It is an authoritative source for defining financial concepts and principles.

- Kiva.org: “About Us”

- Official Link: https://www.kiva.org/about

- Credibility: Kiva is a well-known international non-profit organization. Using its “About Us” page as a source demonstrates that your information is based on the organization’s own mission and operational model.

Disclaimer:

This article is for informational and educational purposes only. I am not a certified financial advisor, and this content should not be considered financial advice. The strategies discussed here are based on personal research and experience. You should always conduct your own due diligence and consult with a qualified professional before making any investment decisions.